Written by Ginel Shane C. Demot

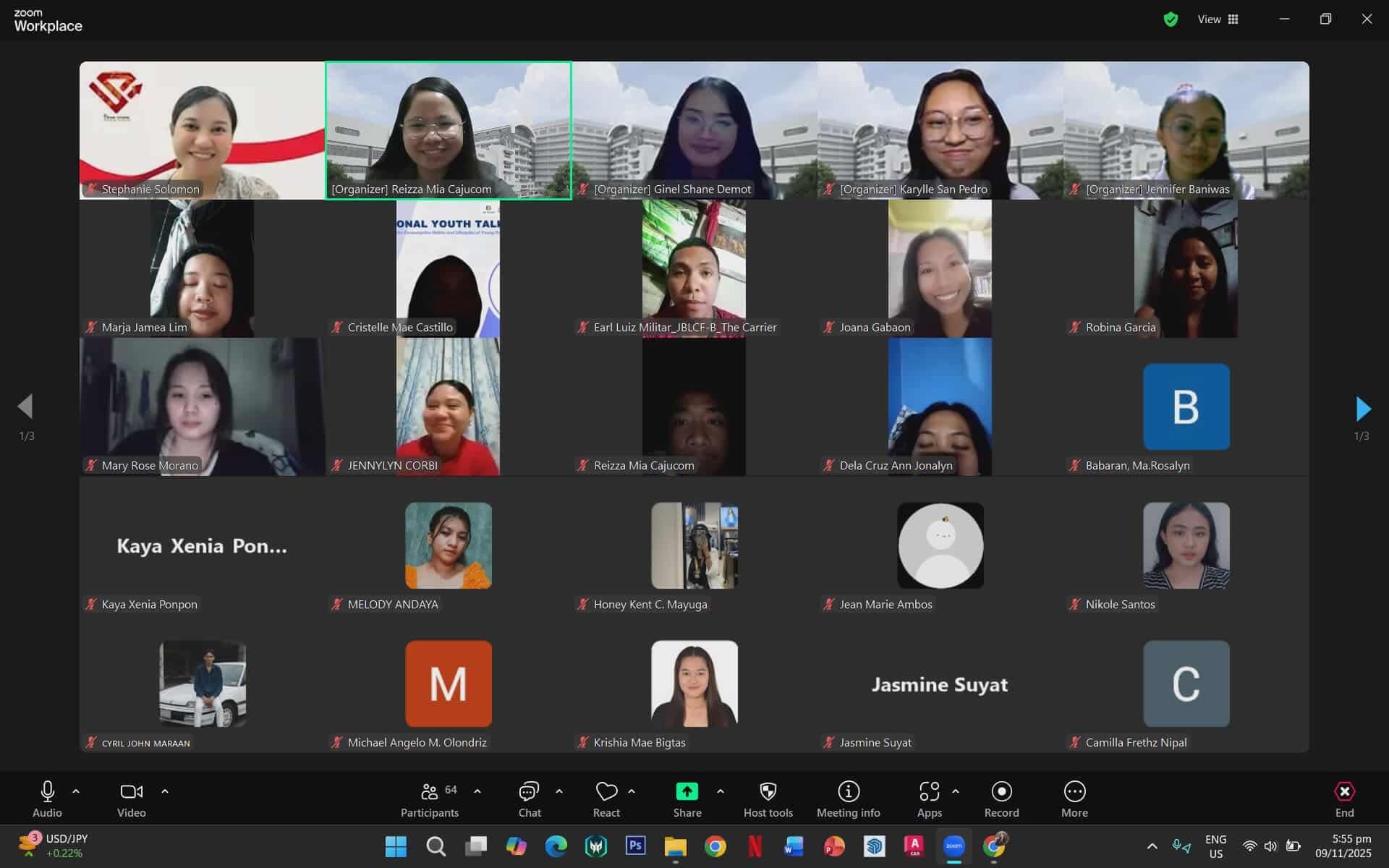

A successful webinar titled “Contracting Certainty in an Uncertain World: The Theory and Practice of Insurance Law” was held on November 9, 2025, drawing 60 enthusiastic participants from various backgrounds. The event aimed to deepen participants’ understanding of the crucial role insurance law plays in promoting financial security and stability, especially in today’s unpredictable environment.

The webinar featured Ms. Stephanie A. Solomon, CPA, CMA, as the resource speaker. Ms. Solomon is a highly accomplished professional, known for her excellence both in academics and in her professional career. She graduated Magna Cum Laude from the University of Baguio and placed 5th in the October 2015 Certified Public Accountant (CPA) Licensure Examination. She holds two prestigious global designations, Certified Public Accountant and Certified Management Accountant, making her one of the few Filipinos with dual international accounting qualifications.

Ms. Solomon began her career at SGV & Company, one of the Philippines’ leading auditing and consulting firms. Through dedication and outstanding performance, she advanced from an Assurance Associate to Associate Director, handling the audits of several major corporations. Her expertise in auditing and financial management later brought her to BH Properties as an Internal Auditor, where she played a key role in strengthening the company’s internal control systems. Beyond her corporate engagements, Ms. Solomon also contributed to the professional community by serving as a reviewer for aspiring CPAs and CMAs, guiding many young professionals toward success.

Currently, she is a Unit Manager at Pru Life UK, one of the country’s top life insurance companies. In this leadership role, she oversees a team of financial consultants dedicated to helping Filipino families achieve financial protection, long-term stability, and independence through proper insurance and investment planning.

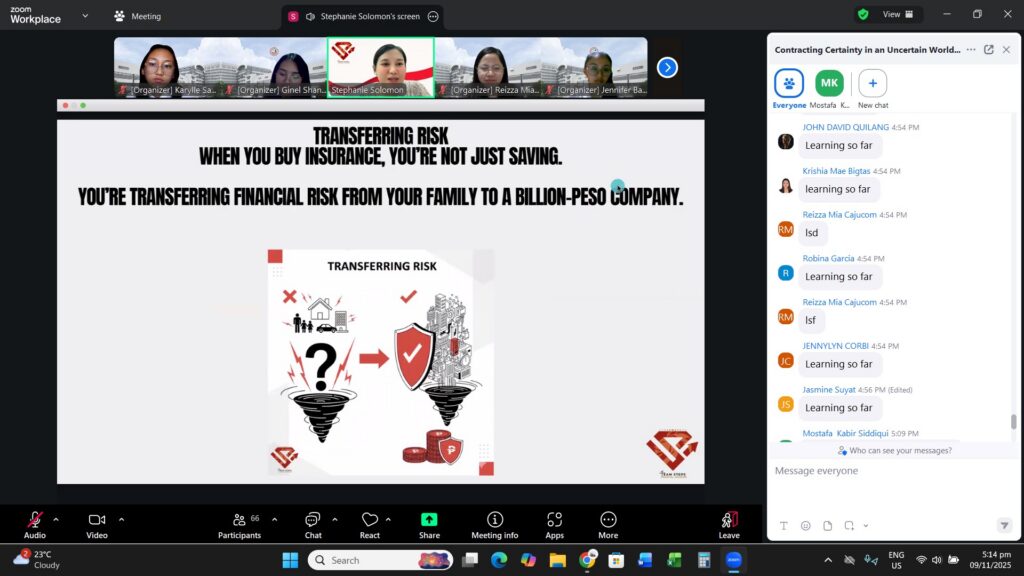

During the webinar, Ms. Solomon highlighted the importance of contracting certainty — ensuring that agreements in the insurance industry are clear, fair, and legally sound. She emphasized that in a rapidly changing world, insurance law serves as a safeguard that protects individuals, families, and businesses from unforeseen financial hardships. She also offered practical insights on how both clients and professionals can apply these principles in real-life situations to secure their financial well-being and peace of mind.

The webinar not only strengthened participants’ knowledge of insurance law but also supported key United Nations Sustainable Development Goals (SDGs), including:

- SDG 1: No Poverty – by promoting financial preparedness and resilience.

- SDG 4: Quality Education – by providing accessible professional learning and development.

- SDG 8: Decent Work and Economic Growth – by enhancing the skills of financial professionals who contribute to economic stability.

- SDG 9: Industry, Innovation, and Infrastructure – by encouraging innovative approaches to financial planning and insurance practices.

After the main discussion, the participants engaged in a short yet lively icebreaker activity designed to energize the atmosphere and encourage interaction among attendees. This brief activity allowed everyone to unwind, connect with one another, and prepare their minds for the question-and-answer portion that followed.

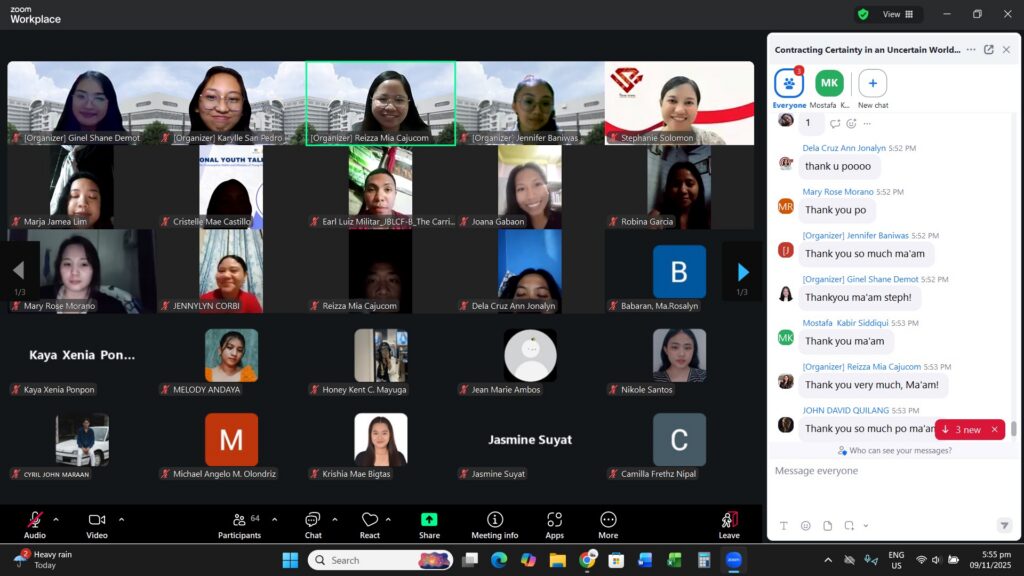

Once the activity concluded, the floor was opened for questions. Participants were encouraged to raise concerns, share personal experiences, and seek clarification on key points discussed during the webinar. The questions covered a wide range of insurance-related topics, including the different types of insurance, the processes involved, the benefits of proper insurance planning, and the practical challenges encountered by both clients and financial professionals.

Ms. Solomon responded to each question with clarity, depth, and real-world insight. She provided thoughtful explanations, offered practical examples, and helped participants gain a deeper understanding of how legal and insurance principles apply in everyday situations.

Overall, the webinar successfully achieved its goal of bridging the gap between theory and practice in insurance law. It inspired participants to apply what they learned in their personal and professional lives, empowering them to make informed financial decisions and contribute to a more financially secure and resilient society.